As auto insurance rates rise, understanding how companies determine your individual rate can be a helpful tool for consumers. But it's all a bit mysterious, isn't it? Not anymore!

It's important to remember that insurance companies are tasked with pricing a personal use product (auto insurance, in this case) without ever meeting the product user (you). This process is increasingly being done without so much as a phone call. So how do insurers determine the right price to charge? It's all about the law of large numbers. By pooling a large number of policyholders, insurers use this statistical principle to set rates that reflect the expected frequency and severity of claims for different groups, adjusting premiums based on the assessed level of risk.

Building your insurance rate

Auto insurers look at a variety of statistically relevant factors to make an educated guess and set your rate. These include:

Your personal details

Age: Drivers between 40-65 often experience the lowest rates; younger drivers (16-25) experience the highest.

Sex: Statistically, females tend to have fewer accidents, resulting in lower insurance rates compared to males.

Employment: Unemployment drives up the cost of auto insurance; if you’re currently employed, you will likely pay less.

Driving record: Citations and tickets are like black marks on your record, resulting in higher rates.

Number of claims: Just like your driving record, the number of claims you’ve filed in the past can have an impact on how much you pay.

Insurance (credit) score: Folks with good credit have fewer claims than folks with poor credit.

What type of car you drive

Use of car: Whether your car is for personal or commercial (including Uber driving) use affects your insurance rate.

Sporty or conservative car: Everyone knows the old adage – a red sports car brings with it higher rates. While the color might not matter as much as other factors, sporty cars come with higher premiums due to higher risk.

Cost to repair: Have a rare car? It will be more costly to repair due to unavailability of parts, potentially resulting in higher rates.

Safety devices: If your vehicle is equipped with advanced safety features, you may qualify for lower premiums.

Trucks vs. cars: Trucks often come with lower insurance rates in relation to cars.

Where you live

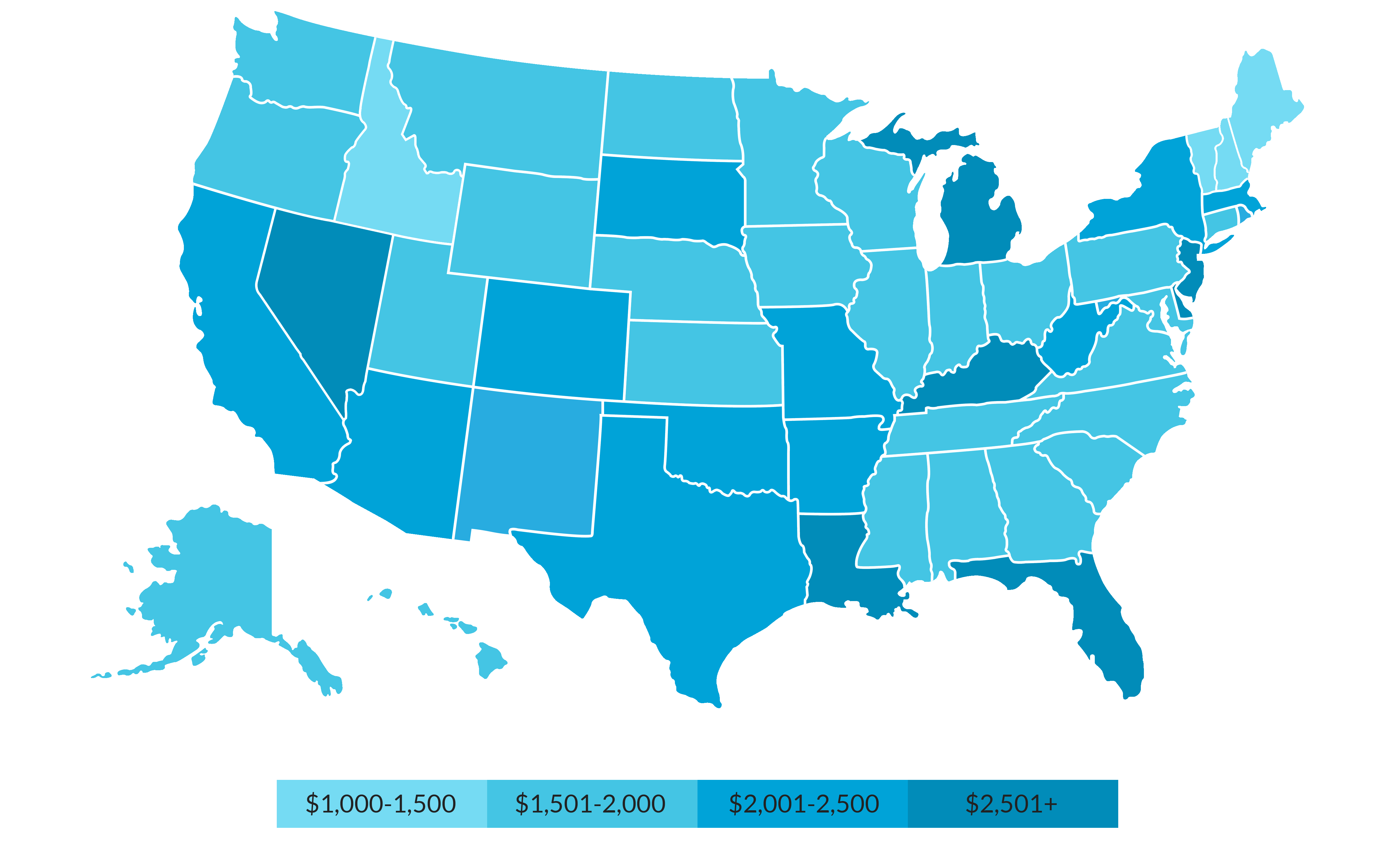

State: Laws and coverage vary significantly between different states - as such, the price you pay for auto insurance can be much higher in certain states compared to others. According to MarketWatch, Michigan is currently the most expensive state for full-coverage car insurance, with an average payment of $3,785 per year.1 Check out the map below to see the relative cost of coverage in other states:

Urban vs. rural areas: Big cities tend to have higher insurance rates compared to smaller towns.

Zip codes and census blocks: Companies look at the smallest possible details to get an idea of whether the area you live is prone to theft, vandalism, and other forms of risk.

Other factors

Types of coverage

There are a variety of different forms of auto coverage, some required and some optional.2 In simple terms, the more coverage you take on, the higher rate you will pay. Here are some of the common coverage types available:

Auto liability coverage: Mandatory in most states, liability coverage helps pay for damages you incur on someone else. There are two components to this form of coverage - bodily injury liability and property damage liability.

Uninsured and underinsured motorist coverage: Helps you pay for medical bills, and sometimes vehicle repairs, in the event you are hit by a driver without insurance or with insufficient liability limits.

Comprehensive coverage: Can pay to repair or replace your vehicle in the event of damage caused by vandalism, theft, fire, or weather event, such as hail.

Collision coverage: May cover the repair or replacement costs if you are involved in an accident with another vehicle or physical object.

Medical payments coverage: If you or family members suffer injury as a result of a car accident, this coverage can help pay for hospital visits and more.

Personal injury protection: Additional coverage for potential injury, PIP can also help cover additional expenses caused by injury, including childcare and lost income.

There are other forms of coverage which can be added to your policy, including rental coverage, new car replacement, towing and labor cost coverage, ride-sharing coverage, and classic car insurance.

As mentioned above, depending on how many options are available to you within your state and how many you choose to include in your policy, the final price will reflect those choices.

Telematics

This is a relatively new offering.

Telematic programs take telemetry data from your car - collected via a provided tracking device - and adjust your insurance rate based on how you drive.3 If you are a conservative driver who is easy on the brakes and gas, doesn't tailgate, and generally stays in their lane while keeping the speed limit in mind, this may be the best option for you.

In addition, some insurers use telematics to offer mileage-based insurance policies, also known as "pay-per-mile insurance". This is perfect for drivers who don't use their car that often.

Telematics is still in its infancy, but it is currently making great strides. You do have to get comfortable being observed, but it will save you money.

--- ---- ---

And that's basically all you need to know about how your auto rate is calculated. There are a lot of elements that you can control, but ultimately much of it comes down to who you are, where you live, and what kind of car you drive.

If you're a 50-year-old, employed, female driver with a good credit history, no tickets, a conservative car, and living in a small town in Maine, you can expect to pay a low rate. Time to move to Bar Harbor!

[1] Market Watch, https://www.marketwatch.com/guides/insurance-services/car-insurance-rates-by-state/

[2] Allstate, https://www.allstate.com/resources/car-insurance/telematics-insurance

[3] Allstate, https://www.allstate.com/resources/car-insurance/types-of-car-insurance-coverage