Every insurer has its own appetite for risk, and when it comes to cannabis and commercial lines, different companies have different comfort levels: some insure retailers and processing facilities, and others don’t.

But when it comes to cannabis growers and processors operating on a personal lines policy, there is zero chance that any standard insurer would willingly maintain such a policy.

In 2013, when Washington first legalized cannabis for recreational use, the insurance industry assumed exposure would predominantly be isolated to farms, processing facilities, and purpose-built retail spaces. And while much of the industry has remained contained within these expected bounds, exposure has crept beyond, not only within commercial lines, but personal lines as well.

-- --- --

The WSRB and BuildingMetrix® team has developed a cannabis occupancies service, designed to pinpoint cannabis operations and provide insurers with insight into their own books of business. We do this by taking a robust and continuously updated data set of known cannabis businesses and running those points against written policies.

The majority of the hits we uncover are commercial operations, usually processing facilities or retailers. But recently we’ve discovered something rather disconcerting: cannabis businesses attached to personal lines, homeowners’ policies.

While most cannabis locations we find are commercial, in an environment, such as personal lines, where the right answer is zero, the number of hits is very meaningful.

The personal lines cannabis operations that we’ve uncovered thus far are well hidden and hard to detect using normal underwriting practices. On paper, they look like regular homes, and just by taking a look at them, you’ll understand why.

Our hits

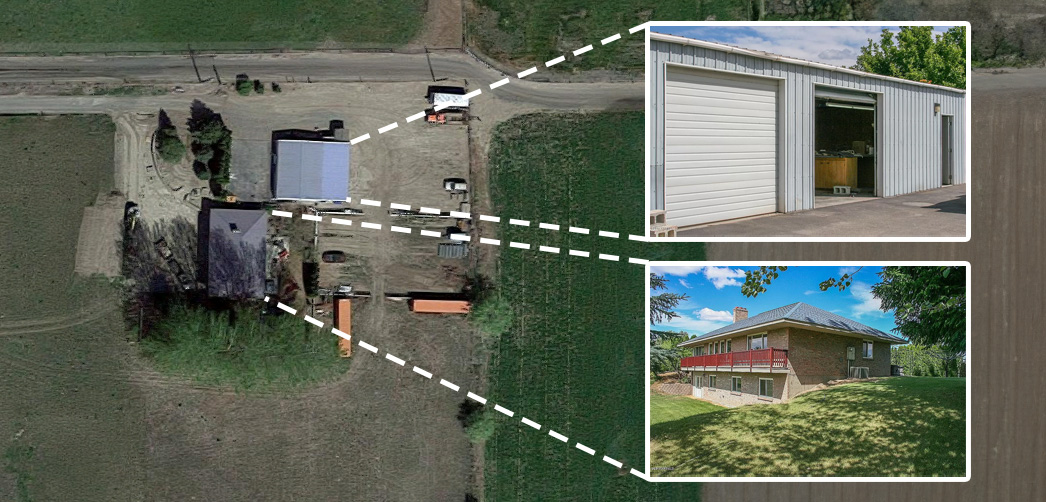

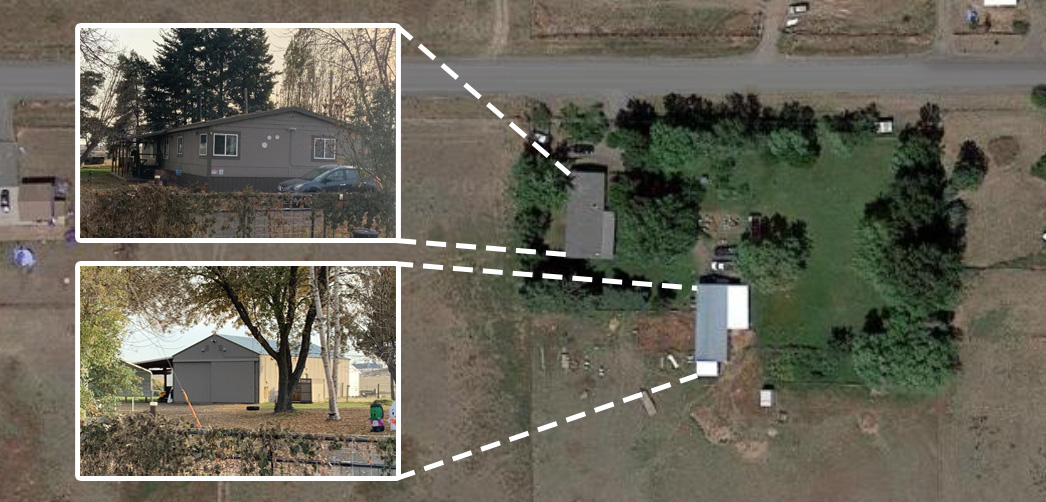

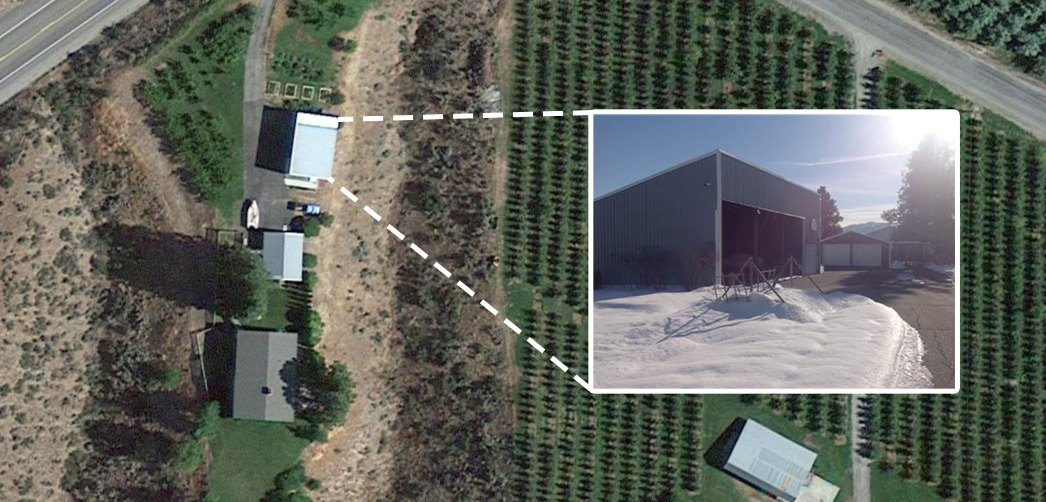

Included below are five unique properties, matched to our cannabis dataset as direct hits.

Property A

Property B

Property C

Property D

Property E

As indicated by the visual resources available on each of these properties, nothing explicitly demonstrates the existence of cannabis production or processing; however, cannabis operations exist at all five properties, bringing with them exposure to the insurers writing the personal lines policies attached to each.

Exposures

Initial assessment of each of these personal lines cannabis operations illuminates a variety of notable exposures:

Property A

- Grow/processing building, likely not designed to grow or process cannabis, located close to home - Fire

- Storage of unknown chemicals and supplies close to home - Fire, Theft

- Open accessibility, creating the potential of attractive nuisance for local kids - Liability, Theft, Vandalism and Malicious Mischief

Property B

- Grow/processing building, likely not designed to grow or process cannabis, located close to home - Fire

- Facility is close to neighboring property, potentially constituting an attractive nuisance - Liability, Odor Complaints

Property C

- Very large grow operation with buildings likely not designed to grow or process cannabis - Fire

- Remote location - Fire, Theft

Property D

- Grow/processing building likely not designed to grow or process cannabis - Fire

- Remote location - Fire, Theft

- Children on premises (see trampoline in photo), potentially constituting an attractive nuisance - Liability

- Very large power transformers on property - Fire

Property E

- Grow/processing building, likely not designed to grow or process cannabis, located close to home - Fire

- Easy access from the road, potentially constituting an attractive nuisance - Fire, Theft, Liability, Odor Complaints

In addition to these localized exposures, every cannabis operation carries with it the possibility for additional liability in relation to the product.

Knowledge is power

The hits outlined above demonstrate the importance of awareness in insurance underwriting. These are personal lines, homeowners' policies covering known cannabis operations, a combination which should never occur. And yet they do - why?

Lack of Disclosure: Upon initial application, a homeowner could fail to disclose or deliberately conceal cannabis operations.

Evolution of Activities: A policyholder might have - upon application - engaged in activities covered under their homeowner's policy, such as gardening or small-scale farming. However, a later transition into growing cannabis without updating their insurance provider could have occurred.

Insufficient Tools: The previous two reasons rely on the homeowner to proactively disclose information to the insurer. Underwriters also have the ability to proactively ensure proper coverage is employed. However, given the sizable lift required to double and triple check the ins and outs of each policy, and the challenge of accurately identifying hidden cannabis operations therein, things slip through the cracks and go unnoticed.

-- --- --

Our cannabis occupancies service, CannabisFind, offers up-to-date, validated data on each insured location in your book, enabling swift identification of cannabis operations currently covered under personal lines policies.

Working with us can save countless hours by focusing on addressing just those policies that need attention rather than scrutinizing every policy individually. You can also quickly and easily estimate your total insured value at risk.

If you want to learn more about how to reduce cannabis property risk, check out some of our content on the subject or contact us.