People love their pets - why else would 2 out of every 3 U.S. households own a pet and spend a cumulative total of $137 billion a year, a rate of spending which continues to grow year after year?1

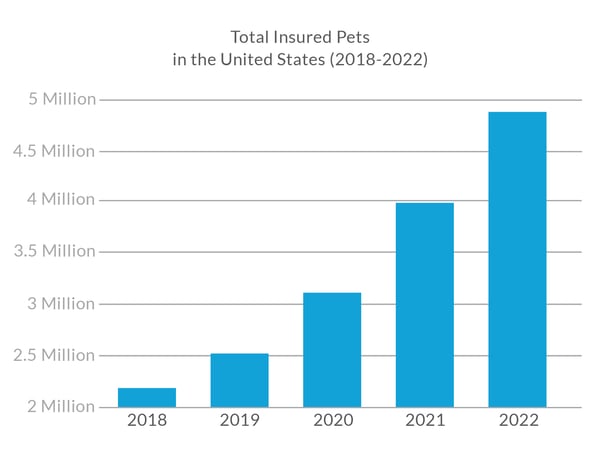

Alongside the ever-increasing amounts we spend pampering our cuddly critters, the popularity of pet insurance has skyrocketed. Between 2018 and 2021, the number of insured pets has nearly doubled.2

What’s it all about? Why has pet insurance become such a mainstay for animal aficionados? Let's explore the following related topics:

What types of pets are covered?

How to get the most out of pet insurance

The best cat I’ll ever own

In 2009, my aunt came over for a visit; she was permanently leaving the country for work and needed help tying up loose ends. “I’ve got this cat that I don’t know what to do with”, she said. “Is there any chance you’d like to take care of her?”

I’ll be the first to admit that the prospect frightened me. You see, my family had always been “dog people”, and most of my feline encounters ended in scratches and the occasional hiss. But I relented, agreeing to provide room and board to my newly acquired charge.

The cat, Mee (named for her distinctive respiratory intonation), quickly stole my heart. And all these years later, she continues to do so, leaving me to question one of the foundational precepts of my youth: do dogs really rule while cats merely drool?

The funny thing is that, when my aunt deposited Mee on my doorstep, I never expected her to live this long. Heck, we all thought she was 10 or 15 years old at the time; in reality, she was closer to three. The discovery of her real age came from a thorough paper trail that also revealed her original birth name: Iridescent Chocolate Chip. I’ll be forever thankful my aunt changed the name to something sensible and normal.

At well over 17 years old, Mee rivals the oldest of her breed. She’s lost a few of her nine lives, taking a tumble or two off the kitchen counter, but has managed to far exceed the expected lifespan of similar cats. She’s never had any major health problems and has been nothing short of a pleasant addition to my family. Are most cats like this? Perhaps she is an anomaly.

Ultimately, getting a pet is like playing poker: it’s nearly impossible to know what you’re going to be dealt. There will always be factors beyond your control. It can be scary, especially when we grow emotionally attached. Maybe I was just lucky, hitting jackpot with a cat (one which I liken in poker parlance to a Royal Flush) that didn’t have many problems and, therefore, left my wallet relatively untouched.

However, this is not always the case. Thankfully, the gamble of pet ownership, with all the potential pitfalls, can be softened with insurance.

What is pet insurance and why is it important?

Pet insurance is increasingly popular; more and more pet owners seek to protect their beloved furry, feathered, or scaly friends in whatever way they can. It functions similarly to regular health insurance, providing peace of mind to pet owners by lessening the financial burden during stressful and emotionally challenging times. Unexpected accidents, illnesses, and injuries can cost a pretty penny; pet insurance helps offset these veterinary expenses to keep pets healthy and happy.

Company to company and state to state, coverage will vary. But in general, pet insurance can provide owners benefit in a variety of ways:

Financial Protection

As mentioned above, veterinary care can be expensive, especially when it comes to emergency procedures and chronic conditions. Insurance can help cover the costs of unexpected treatments, surgeries, medications, and hospitalizations.

Peace of Mind

Rest assured that, should the worst happen, there’s no need to make the impossible choice between pet and pocketbook. This allows pet owners to make informed decisions based on the best interests of their pets, rather than being limited by financial constraints.

Preventive Care and Wellness

Certain policies provide coverage for vaccinations, check-ups, and procedural dental cleanings. These routine procedures are essential for maintaining a pet's overall health and catching potential issues early, helping to ensure better outcomes and reduced medical expenses in the long run.

Lifetime Coverage

Enrolling pets in insurance while they are young and healthy can secure lifetime coverage. Pre-existing conditions are often excluded from coverage; the later in the game owners attain coverage, the more likely known conditions will be disqualified.

Varied Coverage Options

Providers offer a range of coverage options, from basic accident coverage to comprehensive coverage that include illness, hereditary conditions, and alternative therapies, enabling pet owners to choose a policy that best suits their individual needs and budgets.

Emergency Preparedness

Accidents and emergencies can catch owners off guard. Pet insurance acts as a safety net, making it easier to tackle the unexpected without hesitation.

Advanced Treatments

More treatment options are available to pets than ever before, including chemotherapy, MRI scans, and surgery. These treatments can be prohibitively expensive, but insurance can make them accessible.

Euthanasia and End-of-Life Care

Sadly, all good things must come to an end; losing a pet is an unfortunate reality of ownership. Certain policies provide coverage for end-of-life care, enabling owners to say goodbye without the worry of excessive financial burden.

Does pet insurance cover all types of pets?

Not all policies are created equal. Some offer more robust coverage, while others merely safeguard against mild accidents; each is unique, offering specialized coverage based on the provider and the desires of the policyholder.

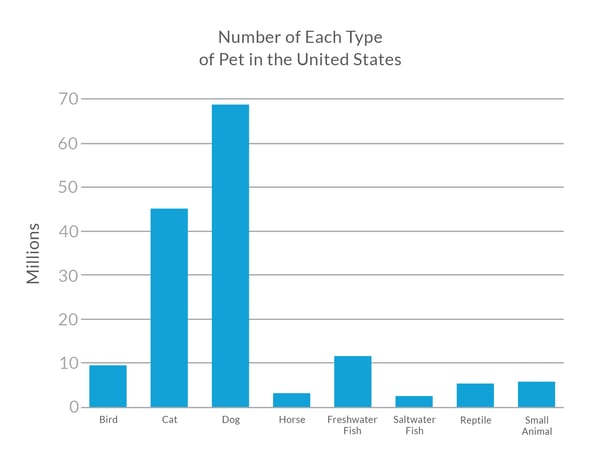

The same is true for what types of pets are eligible for coverage. When we think of pets, its often the old tried and true: dogs and cats. But the world is a diverse place, and pets come in many forms.

My aunt, the same one who gifted me my feline friend, is a good example of what pet ownership can look like. Over the years, she’s owned frogs, spiders, lizards, snakes, and giant African snails. Of course, not everyone has a taste for the exotic, but birds, reptiles, and smaller mammals are all popular animal companions.

As such, pet insurance is available for various types of pets, not just limited to dogs and cats. Many insurance providers offer coverage for other domestic animals like birds, rabbits, reptiles, and small mammals such as guinea pigs and ferrets; some even provide coverage for larger creatures such as horses.

However, most insurance companies have restrictions regarding certain breeds or species, so-called "no no breeds” - animals that are considered higher risk due to danger or historically breed-specific health issues. These restrictions vary from one insurance company to another, and pet owners should carefully review the policy terms to ensure their pet's breed is covered.

What does the average pet insurance policy cover?

There are a variety of different types of pet insurance plans:3

Accident-Only Coverage: excludes illness and wellness coverage

Illness-Only Coverage: excludes accident and wellness coverage

Accident and Illness Coverage: combines accident and illness coverage, but usually excludes wellness

Wellness Coverage: helps pay for routine care, such as check-ups, vaccinations, and dental cleaning

Comprehensive Coverage: incorporates accident, illness, and wellness coverage into one complete policy.png?width=600&height=375&name=MicrosoftTeams-image%20(5).png)

The coverage provided by a given policy varies depending on the insurance provider and other factors. However, comprehensive coverage can include:

Accidents: broken bones, cuts, and bites.

Illnesses: various diseases, infections, and chronic conditions, excluding some pre-existing conditions

Diagnostic Tests: X-rays, blood work, ultrasounds, and similar procedures

Surgeries: both minor and major operations, including emergency and elective procedures

Hospitalization: hospital stays, nursing care, and medication administered

Prescriptions: medication for a variety of different conditions

Cancer Treatment: chemotherapy, radiation therapy, and surgery

Chronic Conditions: long-term management and treatment of ongoing conditions

Dental Care: cleanings, extractions, and disease treatment

Emergency Care: urgent care, including after-hours and weekend visits

Only some policies offer the following services:

Euthanasia and Cremation: end-of-life services, including euthanasia and cremation

Hereditary and Congenital Conditions: health issues inherited or present at birth

Alternative Therapies: acupuncture, chiropractic care, and physical therapy

Liability coverage

Each year, roughly 4.5 million people are bitten by dogs; supplementing pet insurance policies with adequate liability coverage can help ensure protection no matter what happens.

Pet insurance does not offer liability insurance coverage; these policies only cover health-related issues. That said, most homeowner/rental insurance include some form of liability insurance coverage for animal-caused claims.

If your pet bites someone or destroys property, having the proper coverage in place can save you from a heap of trouble.

Of course, there are exceptions and exclusions, including specific breeds deemed too dangerous. Learn more about pet liability coverage here.

How much does pet insurance cost?

Every pet, and every policy, is different. A look into national averages for prices and life expectancy can give us a ballpark understanding of how much insurance costs and whether it is worth the expense.4, 5

For the sake of this example, let’s look at both dogs and cats. These figures only factor in the price of normal preventative care.

Dogs

Average life expectancy: roughly 12 years

Average monthly insurance cost in 2022 (Accident and Illness Policy): $53.34

Average price per year: $640.04

Average price overall: $7680.96

Cats

Average life expectancy: roughly 14 years

Average monthly insurance cost in 2022 (Accident and Illness Policy): $32.25

Average price per year: $387.01

Average price overall: $5418

Obviously, these numbers represent the national average, and distinct differences from pet to pet, as well as the intricacies of each insurance policy, will impact these figures. There are a variety of factors that impact pet insurance prices, including:6

Coverage options: including annual limit, deductible, and reimbursement rate

Breed: certain types of pets, especially purebreds, can be predisposed to illnesses

Age: older pets are always more expensive to cover than younger ones

Location: premiums vary geographically based on a variety of costs, including veterinary care expenses

Discounts: enrollment bonuses for multiple pets or early payment

Provider: each company weighs risk factors in their own unique way

Considering that a single trip to the emergency room can cost thousands of dollars, and even more for surgeries, the cost of insurance over the entire lifespan of a cat or dog may be less than the cost of one of these incidents. And depending on the coverage provided, pet insurance has the ability to cover most, if not all, of routine health services – in some cases, it can pay for itself with the amount of money saved on checkups, dental care, vaccinations, and other regular services.

How to get the most out of pet insurance?

For pet owners seeking insurance, it important to have a complete understanding of available policies, supporting an informed decision regarding suitable coverage for their pets. Understanding the nuances of different plans ensures that they can adequately meet their pet's specific needs and be financially prepared for unexpected veterinary expenses.7

Selecting the right pet insurance involves carefully reviewing the terms and conditions, coverage options, exclusions, deductibles, and reimbursement percentages offered by various insurance providers, and taking the time to read reviews from other pet owners.

Before selecting a policy, here are some important things to consider:

Start Early

Enrolling as early as possible is imperative. Coverage for young and healthy pets is not only cheaper, but often omits exclusions for pre-existing conditions. This proactive approach remains crucial even after obtaining insurance: staying up-to-date with vet visits and preventative care reduces the likelihood of future costs.

Understanding Coverage Limits

Customers must familiarize themselves with the policy's coverage limits, deductibles, and reimbursement percentages - some policies have annual or lifetime caps, while others may have per-incident limits.

Keep Medical Records

Maintaining detailed medical records of pet health history, including treatments, medications, and vaccinations, can help support claims and ensure accurate coverage.

Submit Claims Promptly

After requiring medical attention, submitting pet claims promptly can ensure timely reimbursement.

Stay In-Network

Some insurance providers have a network of preferred veterinarians; using them usually means discounted rates and easier claim processing.

Save up

Even with robust coverage, pet-related expenses can pile up; a dedicated pet savings account can provide an extra financial safety net for unexpected expenses.

In conclusion

Pet ownership is not something to take lightly – it requires dedication and constant care – and pet insurance helps guarantee a quality life for our four-legged sidekicks. Recent years have seen a drastic uptick in the amount of these types of insurance policies, a change that speaks to the security, peace of mind, and freedom they can offer.

We all want what’s best for our pets. Beyond getting them that cute holiday sweater or new squeaky toy, pet insurance may be the best way to ensure their lives continue to be happy, healthy, and safe.

[1] American Pet Products, https://www.americanpetproducts.org/press_industrytrends.asp

[2] NAPHIA, https://naphia.org/industry-data/section-2-total-pets-insured/

[3] Annuity Expert, https://www.annuityexpertadvice.com/pet-insurance/

[4] NAPHIA https://naphia.org/industry-data/section-3-average-premiums/

[5] Finmasters, https://finmasters.com/pet-spending-statistics/

[6] Market Watch, https://www.marketwatch.com/guides/insurance-services/pet-insurance-cost/

[7] US News, https://www.usnews.com/insurance/pet-insurance/what-is-pet-insurance