The pictures of places affected by an earthquake, severe storm or other natural disaster often have a puzzling feature: some homes and buildings have survived while others have been reduced to rubble. One answer to the puzzle relates to the local area’s building codes.

Well-constructed buildings are more likely to withstand shaking, wind, rain, hail or other forces of Mother Nature. Building codes set standards for construction quality, and the more stringent and better enforced a community’s building codes are, the higher the chances buildings will survive a natural disaster.

For property insurers, knowing more about building codes in a community helps you better understand the risk you’re taking on and more accurately determine premiums.

Once a building is completed, a local official usually conducts a final inspection.

Once a building is completed, a local official usually conducts a final inspection.

Related:

The WSRB Guide to Community Ratings

So how can you, the underwriter, find out more about local building codes? We produce data to help you. When we evaluate a community’s protection class (PC), we also look at:

- How stringent the local community’s building codes are.

- How effectively that community enforces those codes.

Based on this information, we generate a Building Code Effectiveness Grading Schedule (BCEGS®) classification for each community.

How BCEGS works and what the classifications mean

The BCEGS classification for a community ranges from 1 to 10, with 1 indicating exemplary code enforcement and 10 indicating no recognizable code enforcement.

The BCEGS classification for an individual building depends on both where it is and when it was completed. A builder must adhere to the local building codes in effect at the time of construction, and building codes and their enforcement can change over time within a community.

When you look up a BCEGS classification on our website or have it fed directly into your underwriting system via application programming interface (API), you’ll need to know:

- The building’s address or the community in which it is located.

- The year the building’s certificate of occupancy was issued or the final inspection was completed.

Specific instructions on how to get BCEGS data are below. But first, here are a few other important notes about BCEGS:

- The earliest year BCEGS classification data is available for any community is 1997, the first year of evaluations. However, not every community was evaluated that first year, so the earliest year BCEGS classification data is available for many communities will be 1998, 1999 or later.

- If a BCEGS classification is not available for a property or community for a certain year, you’ll see a classification of 99 rather than 1 through 10.

- Most, but not all, communities participate in the BCEGS evaluation process. For properties in communities that don’t participate, you’ll also see a classification of 99 rather than 1 through 10.

- If the insurer you work for does not currently use BCEGS in the underwriting process and wants to start using it, your employer will first need to notify the Office of Insurance Commissioner (OIC) and get OIC approval.

Related:

BCEGS: Because Rules are There for a Reason

How to find BCEGS on our website

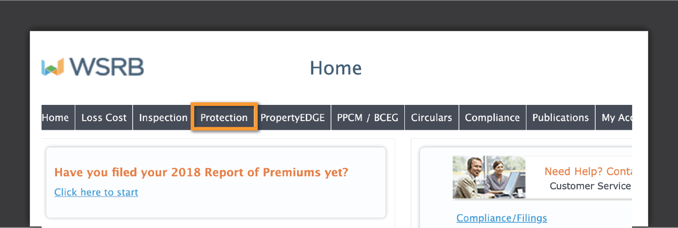

One way to look up a BCEGS classification on our website is with Protection. After you login, click on Protection.

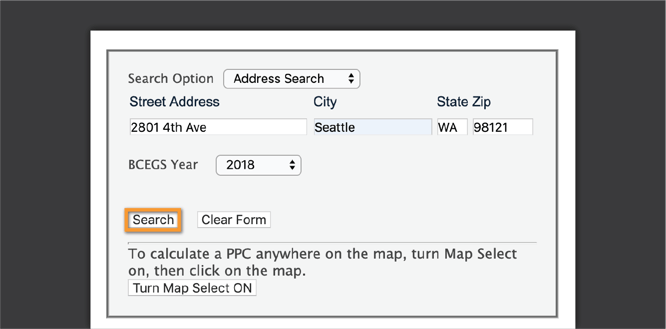

The "Search Option" drop-down menu will default to "Address Search." Leave it as is, and enter the address of a property in Washington state. In the drop-down menu next to "BCEGS Year," select the year the building's certificate of occupancy was issued or the final inspection was completed. Click on "Search."

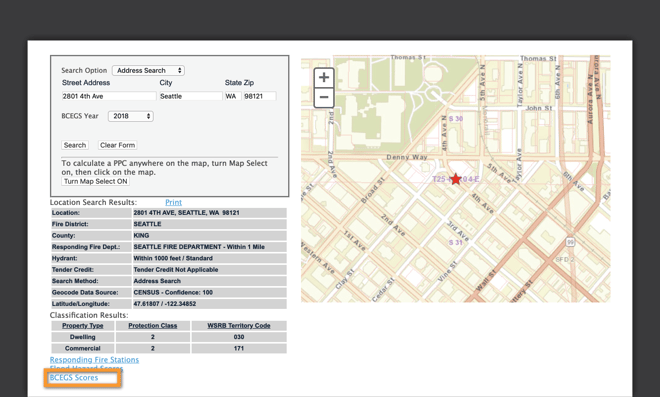

You'll see the results for protection class. At the bottom of the results, you'll see "BCEGS Scores."

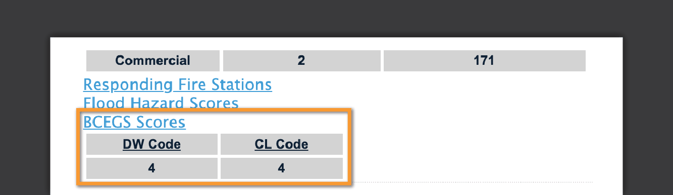

Click on this link, and you'll see the BCEGS classification for dwellings (DL) and commercial (CL).

In our Help Center, we have detailed instructions on finding BCEGS classifications on our website as well as answers to common questions about BCEGS.

How to get BCEGS data fed directly to your underwriting system

We offer all Subscribers the option to access our data through an API, allowing you to have BCEGS data fed directly into your underwriting system and saving you time.

To set up an API, your information technology team will need to work with our technology solutions team. The setup process is quick and can be completed within a few days. Contact us at 206-217-9772 or by clicking here to begin the process.