Essentially, the underwriting job is to determine the acceptable level of risk and price for it.

Even so, underwriters know that certain occupancy risks are beyond risk appetite and pricing: underwriting a munitions factory is a bad idea. On the other hand, main street mercantile and service business is nearly always a winner.

Or so the thinking went.

As risk evolves, and the nuanced overlap of industries increase, occupancy types once viewed as safe bets are becoming more complicated. A recent news story, highlighting legal cannabis and the burgeoning “edible” industry, demonstrates the point.

Cannabis in the kitchen

The New York City institution Magnolia Bakery, renowned for its iconic desserts, has ventured into a new realm by introducing THC-infused versions of their beloved treats like banana pudding and red velvet cake.1 These limited-edition bars contain tetrahydrocannabinol (THC), the component of cannabis responsible for inducing a "high."

The "Swirled Famous Banana Pudding" bar includes vanilla pudding, vanilla cookies, and freeze-dried bananas, while the "Red Velvet Piece Ahhh Cake" bar features red velvet cake, cream cheese flavor, and chocolate. While these baked goods look like normal, non-psychoactive treats, in reality, each 10-piece bar contains 10mg of THC per piece.

Magnolia Bakery’s new foray into pot isn’t an isolated case. As a matter of fact, it’s part of a cresting wave of popularity.

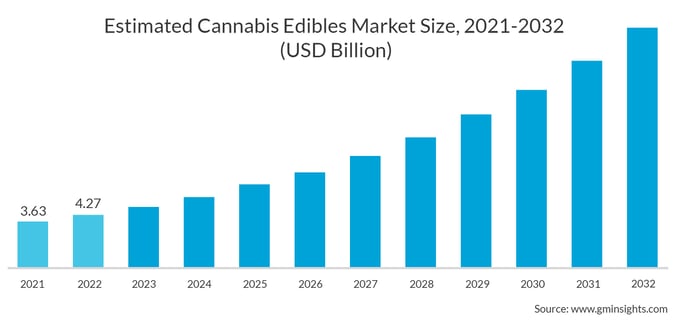

Though edibles still lag behind other cannabis offerings, such as flower (industry terminology for the smokable plant material itself) and vape pens, their growing ubiquity has been well publicized.

Why it matters

The effects of legalization of recreational cannabis have been on the WSRB radar for years, following the Washington legalization in 2013. It’s popular use and ordinary accessibility have predictably grown, and so too has its spread into industries well beyond the expected cultivation, processing, and retail sphere.

And bakeries are just the latest example of unforeseen cannabis exposures emerging in broader commercial segments.

As the popularity of edibles continues to grow, these new confections will become more commonly featured at traditional non-cannabis operations, such as the bakery example above. These are occupancies ordinarily considered desirable low risk commercial classes in conventional underwriting appetites. In view of the rapid emergence of cannabis innovation, it’s likely that a second look is warranted.

Recent conversations with commercial underwriters from mainstream commercial carriers were very brief when we posed the scenario of a commercial submission for a well-established bakery that sells edibles: No.

The notion that leading commercial insurers are not quite ready for cannabis exposure – whether for true products reasons or for complex regulatory and banking reasons – is not new. What is noteworthy however is the breadth of commercial operations which now offer THC infused consumables; coffee shops, candy manufacturers, and restaurants are all expanding to meet demand.

For underwriters, while knowing the latest business class to expand into edibles is helpful, it does beg the question: which of your existing accounts, probably on auto-renewal, have already joined this expansion?

So, who’s next? Hardware stores? Gift shops? Clothing retailers? Tax preparers?

When it comes to bakeries, their foray into edibles is almost predictable. After all, hash brownies feature in some classic 80’s movies, right? But the industry seems to move fast, and with states reporting billion-dollar markets, there are plenty of diverse business classes eager to join in – some as new business submissions, some as renewals.

How can I tell?

The risks inherent in covering cannabis operations, whether production facilities, retail spaces, or purveyors of infused confections, are myriad and already well understood by underwriters.

But it's important to emphasize that product liability for any ingested substance is serious, and possibly an existential issue for an unaware insurer. Defense costs alone are harsh.

What I’ve outlined in this piece may seem insidious: a slow creep of potentially dangerous and undetected exposure taking hold in once unimpeachable bread and butter main street business. We can offer one solution.

Our team at WSRB and BuildingMetrix® has developed a robust cannabis occupancies service CannabisFind, identifying locations involved in the industry. The insight surfaces undisclosed exposures – retail spaces, production and grow facilities, restaurants, and, yes, bakeries – and enables you to manage them intentionally – with very low time and effort.

If you want to learn more about how to reduce cannabis property risk, check out some of our content on the subject or contact us.

[1] CNN, https://www.cnn.com/2023/11/01/business/magnolia-bakery-edibles/index.html