Providing you with helpful information about commercial properties you’re considering insuring is a core purpose of WSRB Loss Costs. We’ve put together a comprehensive reference guide to help you save time and get the most possible value out of your subscription. In this article, you’ll find explanations of essential Loss Cost terminology and links to additional in-depth sources of information.

How are WSRB Loss Costs developed?

First, an inspection:

For specifically rated buildings, the first step to developing a WSRB Loss Cost is a commercial property inspection - one of our skilled analysts visits the property, inspecting the building itself and multiple aspects of occupant operations.

All inspections include:

- Measuring the building's dimensions and drawing a corresponding diagram

- Calculating the building’s square footage

- Determining its construction class and earthquake class

- Checking fire extinguishers and fire suppression systems, such as those installed in restaurants

- Inspecting the automatic fire sprinkler system (if one is installed) and reviewing installation, maintenance, test and other important documentation

- Taking photos of the exterior of the building and adjacent buildings, highlighting potential exposures for you to see

- As of May 2021, our analysts take additional exterior photos and interior photos when possible

We've created a guide to the inspection process for building owners that we encourage you to share with your customers - this guide includes a checklist to help the owner get full credit for any sprinkler systems installed.

Some parts of the inspection process are the same for every type of building while some parts vary. For example, a restaurant, a warehouse and an auto repair shop all present different sources of potential fire risk. Because of this, our commercial property analysts tailor their inspections to focus on the risks relevant to each individual building.

Some buildings can be class rated and don’t require an inspection. According to the Commercial Lines Manual, Rule 85 determines whether a property must be inspected and specifically rated - we've created a summary of Rule 85 available here.

There’s never an additional charge for an inspection; all the inspections you need are included in your WSRB Subscription. Should you need us to inspect or photograph a specific part of the property or operations during our inspection, include a note in the comments section of the Request Inspection form.

A restaurant presents a different set of potential fire risks than a warehouse or auto repair shop - our commercial property analysts tailor inspections to each type of business.

A restaurant presents a different set of potential fire risks than a warehouse or auto repair shop - our commercial property analysts tailor inspections to each type of business.

Related:

Inside a WSRB Property Inspection

Next, a calculation:

All findings from an inspection are translated using our General Basic Schedule (GBS) into a WSRB Loss Cost.

The GBS translates the analyst’s findings into Loss Costs for the building, general contents, and contents for each occupancy type description. The GBS uses engineering, building code, and fire protection principles and adds a charge for each deviation from a building and occupancy that presents minimal fire risk.

You can learn more in our recent blog post on what WSRB Loss Costs are and how they help you.

How do I read a WSRB Loss Cost publication?

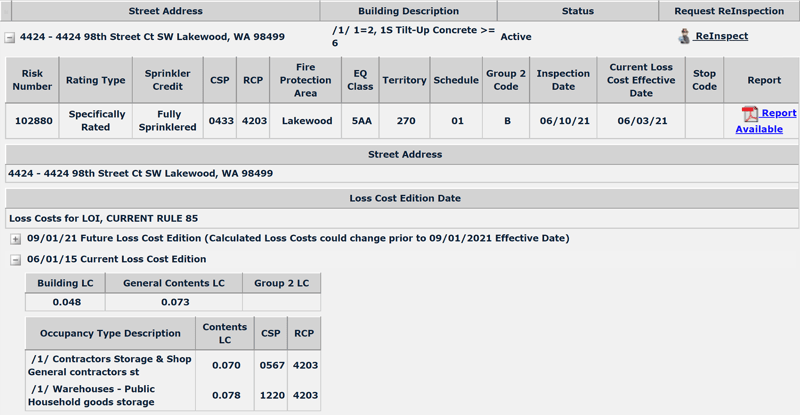

Let’s walk through the key elements of a WSRB Loss Cost. Here’s a screenshot from a recently inspected property.

At the top, you’ll see the building’s mailing address, description, and status. If the status is "Inactive", please request a new inspection by clicking on "ReInspect" and filling out the inspection request form. A status of "Inactive" means that although we did inspect the property in the past, the information we have is out of date. Requesting a new inspection will ensure you get accurate, up-to-date information.

In the next row, you’ll see the Risk Number, which we assign. You can save this in your records and use it to quickly search for this property again in the future.

Sprinkler credit

Moving one column to the right, you’ll see information about the property’s sprinkler credit. “Fully Sprinklered” means the property has an automatic fire sprinkler system that has been properly tested, and maintained, and is sufficient enough to prevent significant damage in the event of a fire.

Under this column, you might see “Partially Sprinklered” or “Non-Sprinklered”.

“Partially Sprinklered” can mean there’s an automatic fire sprinkler system protecting the entire building, but that system isn’t receiving full credit for insurance purposes. It can also mean there’s a system protecting only part of the building - in such a case, the system receives only partial credit for insurance purposes.

“Non-Sprinklered” means either there’s no automatic fire sprinkler system in the building or there is a system that doesn’t qualify for any credit.

Read our blog post to learn more about why a sprinkler system might not get full credit.

CSP and RCP

The next two columns provide a lot of information in a small amount of space.

The CSP Code (always four digits) tells you about the business being conducted by the building’s occupants. In the example above, the code is "0433", meaning there are multiple non-manufacturing occupants.

Read our blog post to get an in-depth explanation of CSP codes.

The RCP code (always four digits) tells you Rating, Construction Class, and Protection Class information. This building’s RCP is "4203". The "4" indicates it’s specifically rated with sprinkler system credit, the "2" means it’s joisted masonry construction and the "03" means the building has Protection Class (PC) 3 - because PCs can vary from 1 to 10, the last two digits are reserved for them.

Read our blog post for a comprehensive look at RCP codes. We also have a series of posts on Construction Classes and you can learn more about PCs for individual properties here.

More codes and classifications

The next column provides information about the property’s Fire Protection Area, allowing you to get more details on the fire protection capabilities available locally.

One column over, you’ll find the building’s EQ Class, or earthquake classification. This classification is based on construction features affecting the building's ability to withstand an earthquake. The number tells the type of frame and the letters tell you about other features of the building. For example, this building is "5AA", meaning it has wood or metal floors, roofs, and exterior with load-bearing walls made of concrete or brick masonry.

See our blog post for a full explanation of earthquake classifications for buildings and a guide to each classification code.

The following columns provide a variety of information:

- Territory tells you about the building’s location (typically used for statistical analysis rather than underwriting)

- Schedule tells you the rating group (typically used for statistical analysis rather than underwriting.)

- Group 2 Code tells you about the building’s ability to withstand wind and other uncommon hazards - read our blog post for more information on Group 2 Codes

- Stop Code tells you if there’s a change that’s likely to affect this property in the near future, such as a new rate level, a new PC for the community, or other important changes

To get full sprinkler credit, a warehouse with storage like this will need an automatic

fire sprinkler system that meets specific requirements.

Related:

WSRB's Essential Guide to Commercial Property Risk Assessment

Commercial Property Report

The next section of the Loss Cost publication contains the detailed Commercial Property Report (CPR). Created by the commercial property analyst who visited the building, you can access the report by clicking on “Report Available”.

In the CPR report, you’ll find:

- Year built

- Number of stories

- Total square footage, as measured by our analyst

- Types of construction materials used in the roof, floor, and walls, including the interior finish

- Information regarding:

- The building’s foundation

- Each occupant

- Exposures

- Fire extinguishers

- Automatic fire sprinkler system, if one is installed

- Photo of the building

- Diagram of the building and its immediate surroundings

You can use this information to not only better understand the risk you’re evaluating but also as the basis for Individual Risk Premium Modifications (IRPMs). In Washington state, there are six categories an IRPM could fit into - our CPRs provide information on four:

- Location: accessibility, congestion, and exposures

- Building: age, condition, and unusual structural features

- Premises and equipment: care, condition, and type of premises

- Protection: if not otherwise recognized

Explore how you can use the data in our Commercial Property Reports to offer your customers IRPMs.

WSRB Loss Cost data

At the bottom of your Loss Cost publication, you’ll find previous and current WSRB Loss Cost editions and their effective dates. Simply click on the “+” to access the one you need. You’ll see WSRB Loss Costs for the building, general contents, and for each occupancy type description. You’ll also find the CSP and RCP codes for each occupancy type.

Learn more

Check out our previous blog post for more details on how to read a WSRB Loss Cost publication.

Learn more about how we develop WSRB Loss Costs and get additional useful policy rating and underwriting information in our guide to commercial property risk assessment. If you need additional information, please contact our Customer Service team - we’re here to help and happy to answer any questions you may have.