UPDATED JULY 2024

We’re moving ahead with Part VI of our The Basics of Commercial Lines Rating series.

Remember that WSRB does not create rates. We provide our Subscribers with the information and data necessary to effectively assess risk and determine a rate. We give you the tools you need to perform the craft of rating. In this blog post, we’ll explore the basics of the Basic Causes of Loss form, an important element in rating properties.

Before continuing, be sure to stay informed with similar content by signing up for notifications.

Rating commercial property, like this one, requires

Rating commercial property, like this one, requires

understanding the different Causes of Loss forms.

Related:

WSRB's Essential Guide to Commercial Property Risk Assessment

Basic Causes of Loss perils

Both class-rated and specifically-rated properties are eligible for Basic Causes of Loss coverage, which covers 11 perils, or causes of loss. The Basic Causes of Loss form provides complete descriptions of each peril.

These perils are the only causes of loss for which a claim will be paid under a Basic form policy, and they’re divided into two groups:

|

Group I: |

Group II: |

|

1. Fire 2. Lightning 3. Explosion 4. Vandalism 5. Sprinkler Leakage* |

6. Windstorm or Hail 7. Smoke 8. Aircraft or Vehicles 9. Riot and Civil Commotion 10. Sinkhole Collapse 11. Volcanic Action |

* Sprinkler Leakage is included in Group I whether or not the building is sprinklered.

When developing the premium for Basic Causes of Loss, both Group I and Group II perils need to be rated.

As stated in the Commercial Lines Manual (CLM), Rule 70.D.2., when rating a Basic form policy, the amount of insurance and the coinsurance percentage must be the same for Basic Group I (BGI) and for Basic Group II (BGII).

Related:

When to Use the Broad Causes of Loss Form

How to determine the loss cost

Basic Group I

To determine the Basic Group I Loss Cost, you must first determine whether the building is class or specifically rated.

If it’s class rated, you can find the Basic Group I Loss Costs on the state loss cost pages of the CLM based on CSP class codes.

For specifically-rated risks, you will find the Basic Group I Loss Cost on the loss cost publication for the physically inspected property. For properties in Washington, WSRB provides this information on the Subscriber Solutions website.

Basic Group II

Developing the Basic Group II loss cost takes us into some new territory. Let’s see what it looks like for the state of Washington.

The Group II classification uses symbols to reference construction. In Washington, these symbols are:

A Wind Resistive Construction

AB Semi-Wind Resistive Construction

B Ordinary Construction

For class-rated risks, the CLM contains a chart (Rule 70.E.2.a.(4) in the Washington exception pages) that provides you with the necessary information.

|

|

Construction Code of the building * |

|||

|

CSP Class Code |

1, 2, 3 |

4 |

5, 6 |

9 |

|

All |

B |

AB |

A |

NA |

|

Exceptions: |

|

|

|

|

|

Open Sides |

4B |

3AB |

2A |

NA |

|

0580 (Greenhouses) |

4B |

4B |

4B |

4B |

|

1150 (Builders' Risks) |

2B |

1½ AB |

A |

NA |

|

1185, 1190 & 1200 |

For symbol, see Rule 85.L. in the multistate rates |

|||

|

1300 (Baled Cotton and Cotton Seed Yards) |

NA |

NA |

NA |

B |

|

1650 (Lumber Yards) |

4B |

4B |

4B |

4B |

*Construction Class Codes: 1=Frame, 2=Joisted Masonry, 3=Non-Combustible, 4=Masonry Non-Combustible, 5=Modified Fire Resistive, 6=Fire Resistive

At first glance, the chart can look confusing. A few examples quickly illustrate how it works.

- A frame construction class (CC1) building would be symbol B (Ordinary Construction) for Basic Group II loss costs for most CSP class codes.

- But if the property was a greenhouse (CSP 0580), it would be 4 x the B (Ordinary Construction) loss cost.

Note: When the Group II symbol includes a numerical prefix, multiply the applicable loss cost by that number.

Related:

What is Covered and When to Use the Special Causes of Loss Form

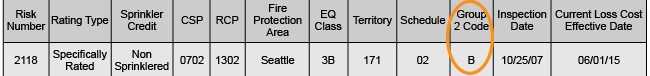

For specifically rated properties, the Basic Group II symbol is shown on the published loss cost page for the property. On WSRB, you will find this on the search results in Risk Search.

Now that you have the BGII symbol, you can find the BGII Loss Costs on the Washington Loss Costs Pages of the CLM, Rule 70.E.2.e. These loss costs apply to both class-rated and specifically-rated properties.

Basic Group II Loss Costs – Property Damage (CF-2020RLA1 Approved 09/01/2021)

| Symbol | Building Loss Cost | Contents Loss Cost |

| A | .016 | .020 |

| AB | .020 | .025 |

| B | .024 | .028 |

To provide you with even further insight, WSRB provides a Loss Costs Publications handbook that explains the information shown on the published loss cost page for specifically-rated buildings in Washington. You can locate this document on the Publications tab of the Subscriber Solutions website.

The factors below apply to Basic Group I and Basic Group II Loss Costs in the following order unless otherwise specified by rule:

- Company filed Loss Cost Multiplier.

- Protection class multipliers: applicable to Group I class rated risks.

- Territorial multiplier; applicable to class-rated risks.

- Causes of loss exclusion adjustment.

- Coinsurance or flat rate adjustment.

- Limit of Insurance (LOI) relativity factor, if LOI rating method* is used (interpolated).

- Factors or charges required by individual rules.

Find the complete Cause of Loss — Basic Form Rule (Rule 70) in Division Five of the CLM.

* “Observations of commercial property losses by limit of insurance indicate that average property losses sustained by policies written at higher limits are generally a smaller percentage of the limit than those losses sustained by policies written at lower limits”. WSRB filing CF-2012-RLC09