When you underwrite an insurance policy, you need information on COPE, four key aspects of any property. Let’s explore what COPE stands for and how you can get useful information on each aspect from WSRB’s Commercial Property Reports (CPRs).

What does COPE stand for?

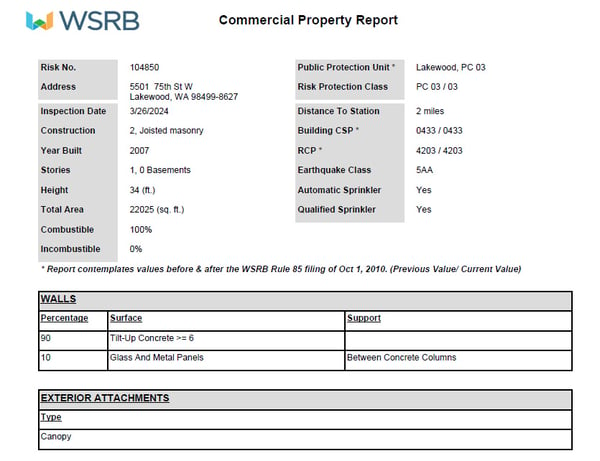

Construction: The building materials used, the age of the building, the construction class, the earthquake class, square footage, number of stories and other building features can all factor into your underwriting analysis.

Occupancy: The operations of the occupants can significantly affect property risk. For example, consider a pizza restaurant with wood-fired ovens versus a customer service call center. Knowing the occupancy helps you make an informed underwriting decision.

Protection: The protection class of the community, the specific property and the presence (or absence) of an automated fire sprinkler system all affect the potential damage a fire could cause to the building. The type of fire sprinkler system — be it for life protection or property protection — also helps you understand how much damage a fire may cause.

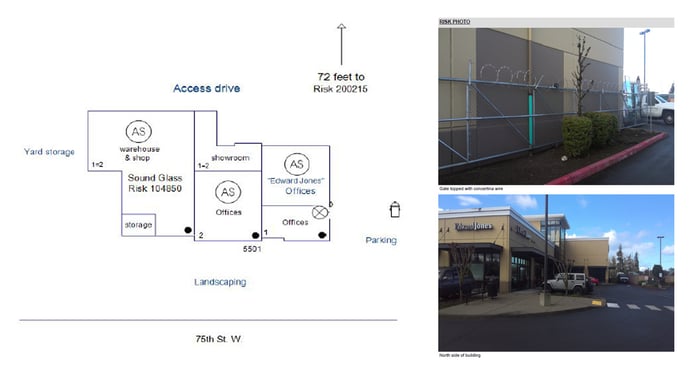

Exposure: The structures surrounding the one you’re underwriting can be as important to your risk assessment as the building itself. The closer those surrounding structures are, the greater the fire peril because a fire could start in a neighboring building and spread to the one you insure. Densely clustered buildings can also create obstacles for firefighters, slowing their response and increasing the risk of property damage. Some exposures pose greater risks than others. For example, a fireworks factory or an automobile painting shop typically create more fire risk than an office building.

The first page of a WSRB Commercial Property Report contains

The first page of a WSRB Commercial Property Report contains

several pieces of useful information related to COPE.

Related:

How to Read a WSRB Loss Cost Publication

How do I get data on COPE?

If you’re underwriting a property in Washington state, our Commercial Property Reports give you detailed information related to each aspect of COPE. To prepare your CPR, one of our skilled commercial property analysts visits and inspects the property. After we conduct a quality review, we email you the report and make it available in the Risk Search section of our website. Here’s what you’ll find in a WSRB CPR.

Construction

- The year the building was constructed.

- The building’s construction class.

- The building’s earthquake classification.

- The building’s RCP code.

- The building’s square footage (measured by our analyst), height, number of stories and basements.

- A detailed breakdown of the building materials.

Occupancy

- Descriptions of the occupancies.

- Hazards associated with each. For example, an office building may have a garage in the basement, meaning motor vehicles are stored on the premises.

- Controls in place for specific hazards. A restaurant may have a UL 300 fire suppression system, or a cabinet-making shop could have an effective dust-collection system, for example.

- Relevant details about the occupants’ operations, such as whether the office building’s first-floor deli includes a kitchen.

Protection

- The community’s protection class.

- The individual property’s protection class.

- The presence or absence of adequately located and maintained fire extinguishers throughout the building.

- Whether the building has an automated fire sprinkler system and whether that system qualifies for insurance credit. If the system doesn’t qualify, the CPR provides a reason, such as the required documentation was missing or our property analyst couldn’t access the sprinkler room.

Exposure

- Photos of all surrounding structures.

- Descriptions of their occupancies.

- Distance from the building being inspected.

- A diagram showing the building being inspected relative to each exposure.

A WSRB Commercial Property Report also includes

A WSRB Commercial Property Report also includes

a diagram of exposures and photos of the risk.

Related:

Inside a WSRB Property Inspection

How do I order an inspection?

To get a CPR for a property in Washington state, simply login and request an inspection. If you’re a Subscriber, you can order as many inspections as you need at no additional charge. If you’re a property insurance carrier in Washington state but not yet a Subscriber, contact us to learn more.

If you enjoyed this article, stay informed with similar content by signing up for notifications.