When we first wrote about the hardening market in commercial insurance back in November, we mentioned that many of today’s underwriters and agents had probably never before worked through a hard market — that is, a market with fast, industry-wide premium increases.

That was before the emergence of the novel coronavirus and the beginning of widespread protests, both of which have led to increases in commercial property insurance claims and potential losses for insurers. Those losses could cause insurers to further increase premiums, but the ultimate impact of the losses remains to be seen.

What we know for sure is that a hard market causes:

- Customers with policies up for renewal to potentially face steep premium increases.

- Agents to look for new ways to get customers favorable pricing.

- Underwriters to seek useful information so they can make precise pricing decisions.

Individual Risk Premium Modifications (IRPMs) can help all three groups, especially underwriters. Our data products and services make it easier for underwriters to maximize and document IRPMs. Below, we explore how, with one caveat: WSRB doesn’t produce data or inspect properties specifically to facilitate IRPMs. Still, our Commercial Property Reports (CPR), protection class (PC) data, and new tools can help underwriters better understand individual risks and make well-informed decisions.

In turn, agents can work with underwriters to document risk-reducing conditions at a business that could make a customer eligible for a smaller premium increase.

Related:

What the Hardening Market Means for Agents and Underwriters

The commercial insurance market continues to harden

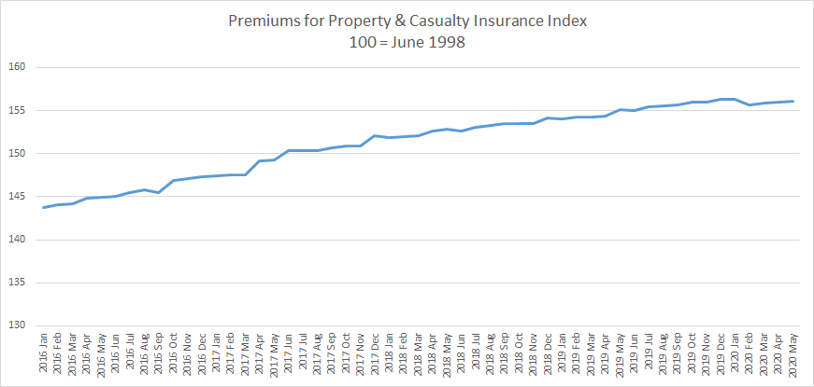

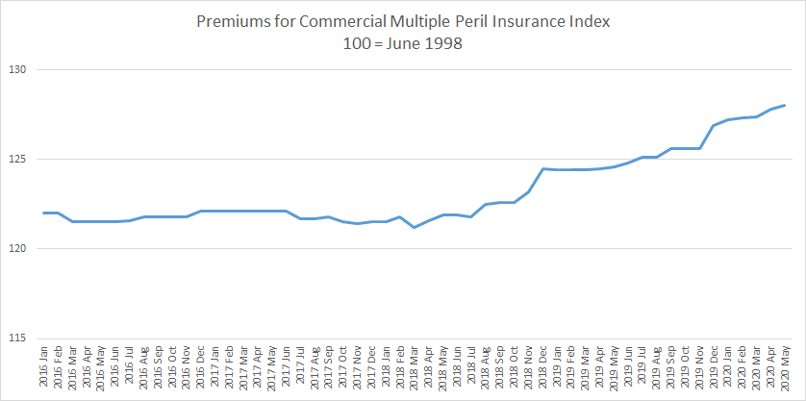

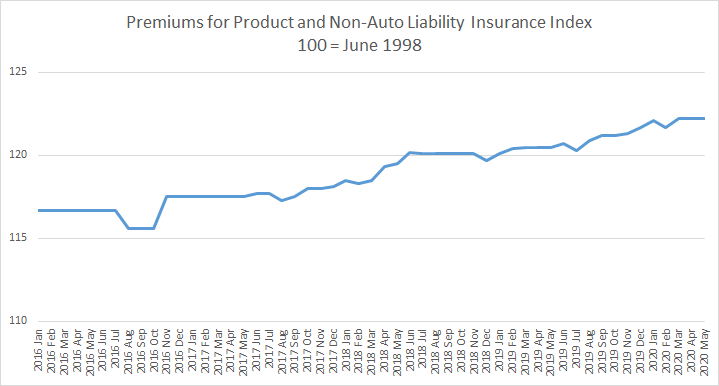

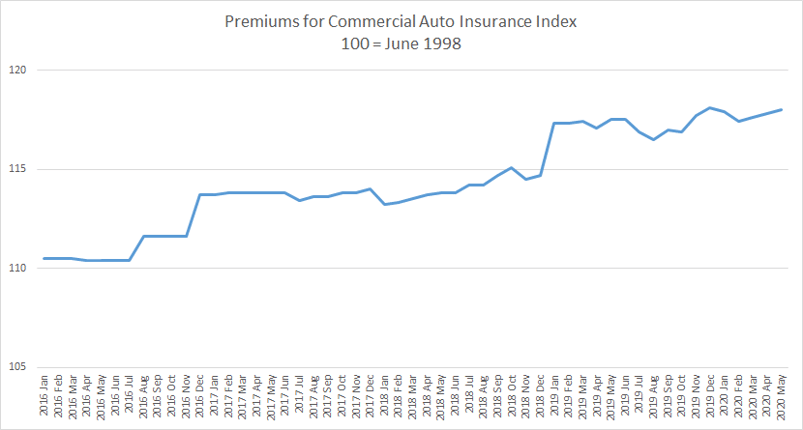

Before we go into how you can use WSRB data products and services for IRPMs, let’s take a brief look at the state of commercial insurance pricing in the U.S. The following data comes from the Producer Price Index (PPI), which is similar to the Consumer Price Index (CPI). Both are produced by the Bureau of Labor Statistics, and both are indexes, meaning they have baseline values of 100. The CPI measures how much people pay for goods and services; the PPI measures how much sellers receive.

In this case, the sellers are insurers, and the baseline value for the indexes (that is, 100) is set to the price levels from June 1998.

Overall, premiums for property and casualty insurance have risen steadily since the beginning of January 2016, with a few small fluctuations during that time.

Premiums for commercial multi-peril insurance remained nearly flat between January 2016 and August 2018. Since then, these premiums have risen.

A similar trend has occurred in premiums for product and non-auto liability insurance, although the increase began earlier, in April 2018.

Finally, commercial auto insurance premiums have been rising, to varying degrees, since the summer of 2016.

All of this data points to one conclusion: the commercial insurance market continues to harden, making now a good time to consider IRPMs.

The five IRPM categories

In Washington state, IRPMs can fall into the following categories for Part 1, Physical and Moral Conditions, on the IRPM worksheet:

- Management: cooperation in safeguarding and properly handling the property.

- Location: accessibility, congestion and exposures.

- Building features: age, condition and unusual structural features.

- Premises and equipment: care, condition and type of premises.

- Employees: selection, training, supervision and experience.

- Protection: if not otherwise recognized.

Our products and services give you information related to all but two of these: management and employees. Let’s break down the other four and how you can use WSRB data and information related to each one.

Location: accessibility and exposures

In our Commercial Property Reports, you’ll find information you can use to better understand any individual risk:

- A photograph and description of each adjacent property along with the distance, in feet, between the building we’ve inspected and the exposure.

- A diagram of the building showing it relative to each exposure and streets.

You’ll also find the building’s earthquake classification, which you can use if you’re writing an earthquake policy.

Our QuakeScout tool gives you even more information about a property’s location and its individual characteristics:

- Modified Mercalli Intensity scale

- Lahar presence

- Tsunami risk

- Susceptibility to soil liquefaction

- Distance to fault line

Login today to try it today.

Building features: age and unusual structural features

Our Commercial Property Reports include:

- The year the building was constructed so you can easily determine its age.

- A photo of the building from the exterior so you can quickly spot features such as sloping roofs that could accumulate snow, unusual building designs that may cost more to replace and more.

Premises and equipment

In this category, you may be curious whether the property has adequate fire extinguisher coverage. You’ll find that information in our Commercial Property Reports. You’ll also find information on whether the property has an automatic fire sprinkler system. If we’ve given the system credit, the advisory loss cost will reflect that, so you couldn’t use it to apply an IRPM because doing so would be double-counting.

However, some buildings have sprinkler systems that we haven’t given credit for, often because design or testing documentation was unavailable on-site or because our commercial property analyst couldn’t access the sprinkler control room. Depending on your company’s policies and guidelines, you may choose to apply an IRPM based on the fact that the building has a sprinkler system even if we haven’t granted credit for it.

Protection

In our Commercial Property Reports, you’ll find the building’s protection class as well as the community’s PC. You can find the protection class for any property in Washington state by logging into Protection and searching for an address. Just remember that if you’ve accounted for the PC elsewhere in the rate calculation, you can’t do so again with an IRPM.

Get more from our reports and inspections

If you’re looking for information to use to apply an IRPM, login and search for a Commercial Property Report today. If we haven’t inspected the building or haven’t done so recently, request an inspection.

Have specific characteristics about the building you’re interested in? Add that to the comments field when you submit your request. Just remember we inspect properties to develop advisory loss costs, so we focus on characteristics related to that goal.