Part II of the ZIP Code Insurance Rating series.

Most of the time, ZIP codes improve accuracy. When the U.S. Postal Service (USPS) delivers mail, ZIP codes increase efficiency. When you use a retailer’s website to find local stores, ZIP codes quickly give you useful results. When you use one of our products, an accurate street address-ZIP code pairing will ensure you’re getting data on the right property.

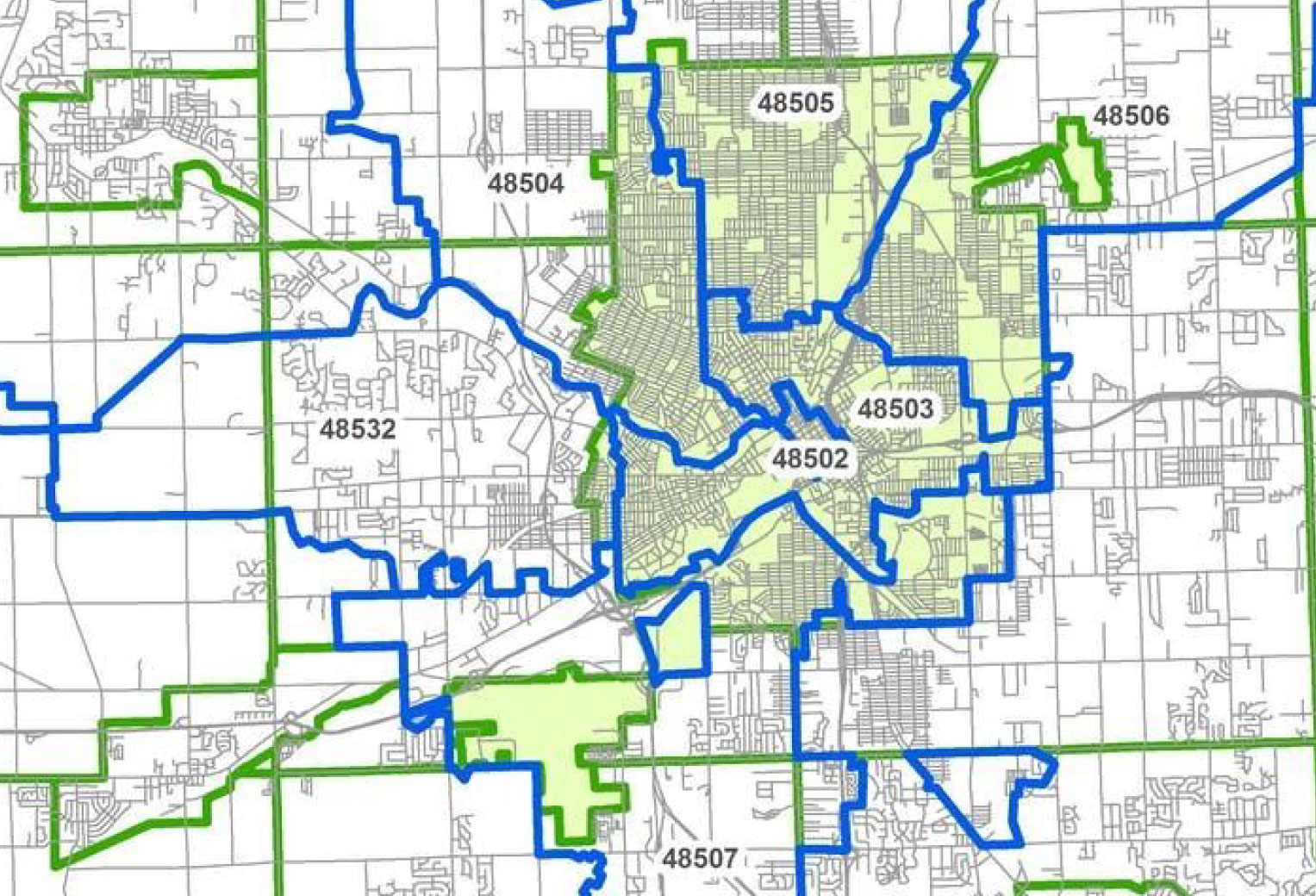

Sometimes, though, ZIP codes don’t help. For example, you can’t use a ZIP code to find an accurate protection class (PC) for a property in Washington state because PCs can vary greatly within a ZIP code. To illustrate, we present two addresses in the same ZIP code: 99301. The first, 1024 W Henry Street, is about eight road miles from the second, 31 Piekarski Road, but the two have very different PCs. For the Henry Street address, the PC is 3; for the Piekarski Road property, the PC is 9.

Two addresses within the same ZIP code can have different PCs.

Two addresses within the same ZIP code can have different PCs.

WSRB provides the insurance industry with PCs for individual addresses to give you an accurate picture of a property’s fire risk. Using ZIP codes to assign PCs wouldn’t give you the information you need, and using ZIP codes to assess many other kinds of property risk also won’t give you the information you need.

Even the USPS considers the ZIP code an “early effort” and believes there’s room to improve its usefulness, accuracy, and precision.1 We’ll go into more detail on that soon, but for now, let’s explore a few of the limitations of the ZIP code in insurance underwriting.

Related:

ZIP Code Insurance Rating: Accuracy

A ZIP code isn’t precise enough to measure property risk

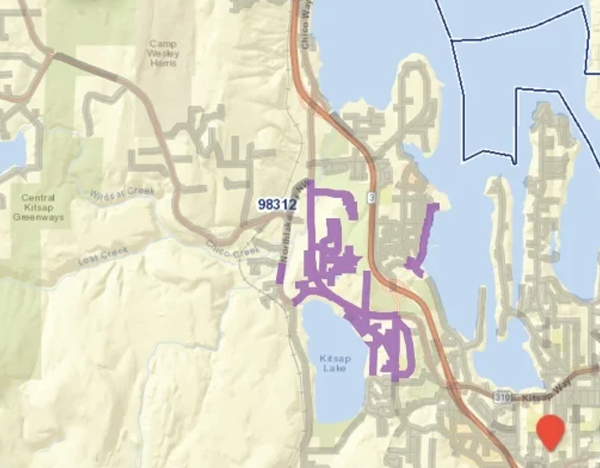

Part of the problem stems from the fact that ZIP codes aren’t what you think they are. We often think of ZIP codes as representing areas, and we frequently use them that way. But ZIP codes actually represent a set of delivery routes. In other words, the ZIP code is a set of pathways postal workers follow. The routes may form a grid, or they may take on another shape, but ZIP codes are a collection of lines, not an entire area.

The ZIP code 98312 is a collection of delivery routes, as shown by the grey lines.

The ZIP code 98312 is a collection of delivery routes, as shown by the grey lines.

A closer look at one of the delivery routes within ZIP code 98312.

A closer look at one of the delivery routes within ZIP code 98312.

The ZIP code does not correlate perfectly with property risk, be it for fire, earthquake, mudslides, flood, or nearly anything else. For example, one risk factor for earthquake property damage is distance to fault line, but fault lines don’t follow ZIP code delivery route lines.

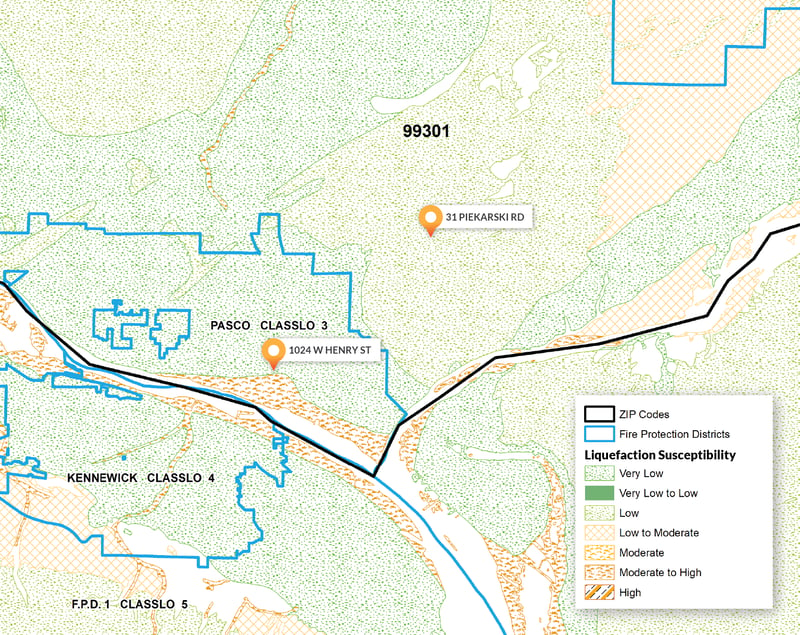

Another risk factor is soil liquefaction, which you saw the last time you went to the beach, and a wave saturated the sand. Some soil types are more susceptible to liquefaction than other types. During an earthquake, a building constructed on susceptible soil may suffer more damage than one constructed on less-susceptible soil. Susceptibility to soil liquefaction can vary from very low to high within just a few blocks, as shown below.

%20part%202/Soil%20liquefaction%20variation%20within%20ZIP%20codes.png?width=799&name=Soil%20liquefaction%20variation%20within%20ZIP%20codes.png) Susceptibility to soil liquefaction may vary significantly within a ZIP code

Susceptibility to soil liquefaction may vary significantly within a ZIP code

If you use a ZIP code to evaluate a property’s risk of earthquake damage, you’ll miss the crucial details of not just soil liquefaction but also lahar presence and Modified Mercalli index, both of which also vary within ZIP codes. Another measure of earthquake property damage risk, the earthquake classification, is specific to an individual building because it’s based on materials used and construction features.

Perhaps you insure many farms or other properties in areas where flood is a more significant risk than earthquake. In that case, ZIP codes still don’t provide precision for evaluating risk. Highly agricultural areas are typically rural and have limited mail service. Residents may have to go to the post office to pick up their mail. Or, multiple families may share the same mailbox.2 The ZIP code associated with that post office or mailbox could be miles away from the property you’re considering insuring and provide little to no valuable information for insurance underwriting.

How to get geographically specific data on property risk

So, what can you do? You’ve already taken the first step. By reading this blog post, you now know the ZIP code isn’t the right data element for insurance rating. You need more geographically specific data. We provide that in PropertyEDGE, which you can use to access a wealth of information all in one place, including all the data points we’ve discussed, along with Federal Emergency Management Agency flood zones, which also don’t align with ZIP codes.

With this property-specific data, you can more accurately predict potential losses and set premiums for risks. You can also more effectively educate customers about their specific risks and offer them customized coverage options. When you point out to customers that their buildings sit on soil highly susceptible to liquefaction and explain what that means, your suggestion to add earthquake coverage to their policy is more persuasive.

If you have questions about using PropertyEDGE or any of our products, we are here to help. Contact our Customer Service team at 206-217-0101.

Related:

To Educate Customers about Earthquake Risk, Look Beyond Fault Lines

The possible future of the ZIP code and how it could help insurance professionals

Since at least 2012, the USPS has been considering making addresses more accurate and precise by geocoding them — assigning a latitude-longitude to each address. We don’t know when, or if, geocoding will happen, but if it does, it would improve mail delivery and potentially enable same-day delivery for e-commerce. Geocoding could also improve your business performance by giving you granular data for marketing and risk management.

Today, you might use ZIP codes to target marketing campaigns at residents based on the average or median income in that ZIP code. But both those income measures can vary within a ZIP code, and you could send marketing flyers to customers unlikely to respond to your offer. With more precise data, you could more effectively target your marketing and increase efficiency.

Geocoded addresses could also give you greater insight into your concentration of risk. We’ve touched on a few property risk factors that vary within ZIP codes. Assessing your concentration of risk using just the ZIP code won’t be as valuable as using geocoded addresses.

Geocoding addresses is only part of the process. The location data would still need to link to other data, such as income or property data. But the potential is there. In the meantime, we’ll continue working hard to ensure the PC and other data we provide you is as accurate as possible.

Check out our previous post about the impact of using an incorrect ZIP code.

[1] The Untold Story of the ZIP Code, https://www.uspsoig.gov/sites/default/files/document-library-files/2015/rarc-wp-13-006_0.pdf

[2] USPS, https://faq.usps.com/s/article/General-Guidelines-and-Policies-for-Rural-Delivery