Western Washington is one of the most earthquake-prone places in the country, yet only 11.3% of homeowners and 43.2% of commercial properties have coverage.

In other words, a lot of Washingtonians need to at least consider getting earthquake coverage. For insurance agents, that creates opportunities to expand relationships with existing customers and add new customers.1,2

Agents need to do two things to make the most of these opportunities: (1) efficiently identify potential customers most in need of earthquake coverage and (2) effectively educate those customers about their earthquake risk. That means understanding where earthquake risk resides and how that risk relates to potential property damage.

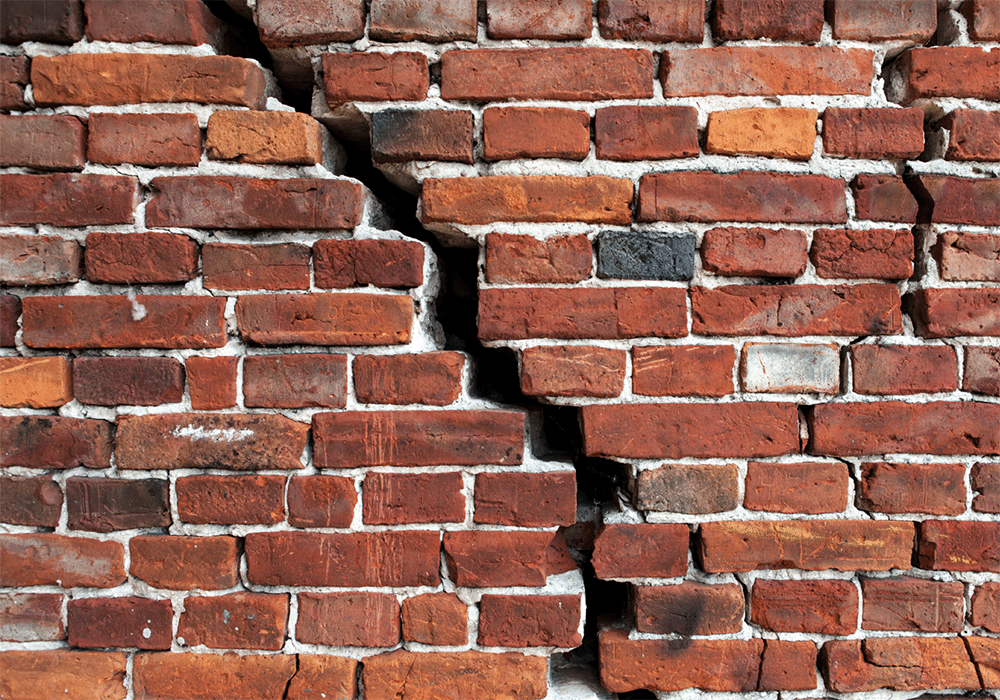

Many prospective customers likely think about their earthquake risk based purely on how far their property is from the nearest major fault line. While distance to fault line is an important risk factor for earthquake-related property risk, it's far from the only one. Give your customers a more comprehensive picture of their earthquake risk by understanding these key risk factors.

Related:

An Agent's Guide to Earthquake Risk

Looking beyond distance to fault line

Other risk factors influencing property risk from earthquakes include an area’s Modified Mercalli Intensity Scale (MMI), lahar presence, tsunami risk, and susceptibility to soil liquefaction.

Modified Mercalli Intensity Scale

Ranging from not felt (MMI I) to extreme (MMI X), the MMI measures the strength of shaking from an earthquake at a specific location. Each point on the MMI scale corresponds to the observed effects of the shaking. For example, an MMI of V — moderate shaking — awakens many people, causes small objects to move and results in a few instances of cracked windows and plaster.3

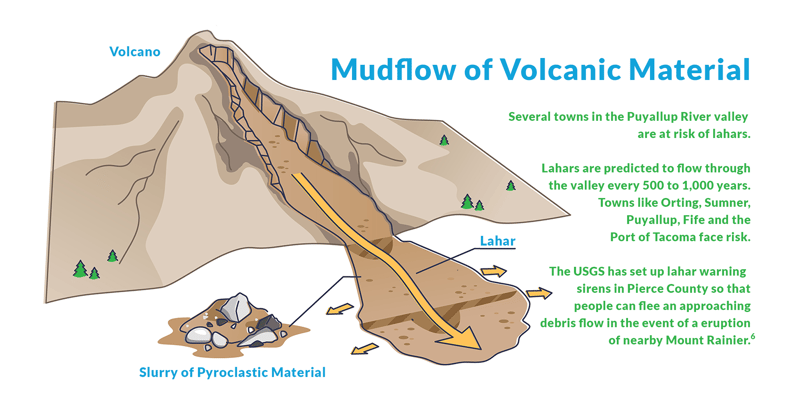

Lahar

A type of mudflow that can take on the consistency of wet concrete and flow downstream at 30 kilometers per hour,4 lahar mudflows usually result from volcanic activity. The 1980 eruption of Mt. St. Helens triggered a lahar mudflow that reached a speed of 100 kilometers per hour, destroying nearly 200 homes, over 185 miles of roads, and damaging bridges and railways.5

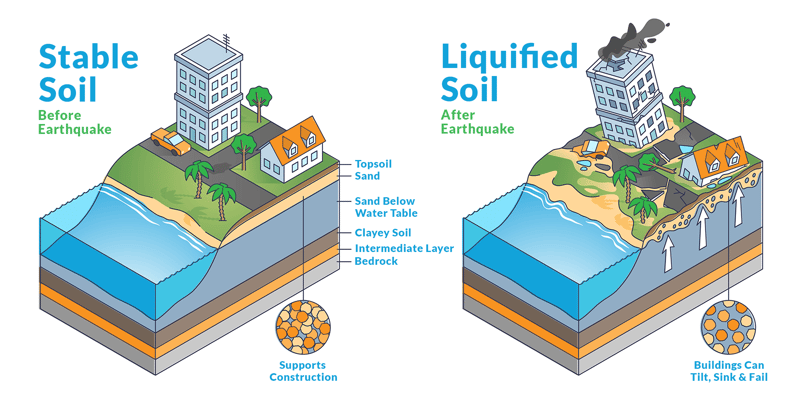

Soil liquefaction

Soft sediment is prone to a process called liquefaction, a state where saturated earth stops acting like a solid and starts behaving like a liquid, similar to quicksand.7 Liquefaction can cause structures to tip and water mains to break, limiting the ability of firefighters to suppress earthquake-caused fires.8 Structures built atop soil prone to liquefaction will likely suffer more damage than structures on less-susceptible soil.

Tsunami Risk

Tsunami risk applies to some coastal areas that could be inundated with an earthquake-induced tidal wave. Washington state earthquake modeling indicates a resulting tsunami could cause widespread property damage.9

From an insurance perspective, the invisible threat posed by tsunamis requires a precise understanding. While the immediate damage is to infrastructure, the long-term financial fallout is far-reaching, making it critical to assess not only the coastline but also nearby waterways and low-lying areas. In the case of Washington, even seemingly protected areas like Seattle and Olympia are susceptible to inundation.

Learn more about tsunami risk here.

Other risk factors include an area's MMI, lahar presence, soil liquefaction

Other risk factors include an area's MMI, lahar presence, soil liquefaction

susceptibility and tsunami risk.

Related:

Underwriting Property: A Guide to Fire, Wildfire and Earthquake Risk

QuakeScout

Together, these factors give you a clearer, more comprehensive view of an individual structure’s susceptibility to property damage than the distance to the fault line alone. You can access all of these elements for any address or latitude longitude in Washington state using our earthquake risk tool: QuakeScout. For detailed instructions on how to use find earthquake risk using our tool, click here.

Show your at-risk customers why they need earthquake coverage. Customers might know they live near a fault line, but they don't know about other key risk factors like those described above. We've built an earthquake agent marketing program offering you the tools you need to educate your customers and power new sales. This program includes:- An engaging, customized webpage that explains each data point with visuals and maps.

- Ready-to-send marketing letters which include each recipient's personalized risk factor data and an overview of what each factor means.

- Insightful data to identify target customers.

Contact us for more information on how we can help you ensure your customers are properly covered.

[1] Time, https://time.com/3002710/earthquake/

[2] Seattle Times, https://www.seattletimes.com/seattle-news/science/survey-finds-only-11-3-of-washington-homes-have-earthquake-insurance/

[3] USGS, https://www.usgs.gov/media/images/modified-mercalli-intensity-mmi-scale-assigns-intensities

[4] Pacific Northwest Seismic Network, https://pnsn.org/outreach/volcanichazards/lahars

[5] USGS, https://volcanoes.usgs.gov/volcanoes/st_helens/hazard_lahars.html

[6] Wikipedia, https://en.wikipedia.org/wiki/Lahar

[7] Encyclopedia Britannica, https://www.britannica.com/science/soil-liquefaction

[9] KOMO News, https://komonews.com/news/local/tsunami-alerts-will-give-you-30-minutes-to-get-60-miles-away-where-can-you-go